The US President has officially announced a series of new tax measures aimed at addressing economic stability, income inequality, and national debt reduction. The proposal, which was unveiled during a press briefing at the White House, is expected to have significant implications for businesses, high-income earners, and the broader economy.

Key Highlights of the Tax Plan

According to government officials, the new tax plan includes several key provisions:

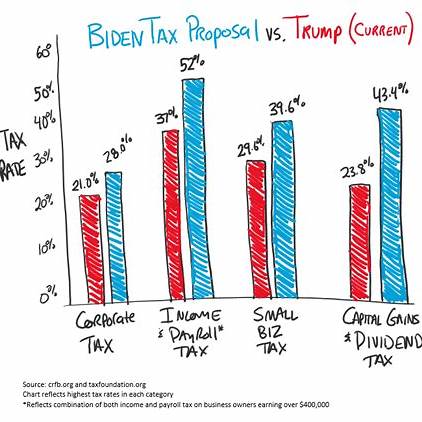

- Higher Taxes on Corporations: The corporate tax rate will see an increase, aimed at ensuring large businesses contribute more to public revenue. This move is expected to generate billions in additional federal income.

- Increased Taxes on High Earners: Individuals earning above a certain income threshold will be subject to higher tax rates, aligning with the administration’s goal of reducing wealth disparity.

- Closing Tax Loopholes: Efforts to eliminate tax loopholes and offshore tax havens are being prioritized to ensure fair taxation across industries.

- Middle-Class and Small Business Relief: While high-income groups will face tax hikes, middle-class Americans and small businesses will receive tax relief measures to support economic growth.

Presidential Justification and Economic Impact

During the announcement, the President emphasized the necessity of these changes, stating, “This tax reform is about fairness and responsibility. We must ensure that those who benefit the most from our economy contribute their fair share.”

Economic analysts have had mixed reactions to the proposal. While some experts believe the tax hikes will provide much-needed revenue for public services and infrastructure, others warn that increased corporate taxation could slow job growth and investment.

Congressional Debate and Public Reaction

The tax plan is expected to face significant debate in Congress, with Republican lawmakers voicing concerns over the impact on businesses. On the other hand, progressive leaders have praised the initiative as a step toward economic equality.

Public response has been divided, with proponents supporting the effort to reduce the wealth gap and critics arguing that higher taxes could strain businesses and economic competitiveness.

What’s Next?

The administration is set to push for legislative approval in the coming months. If passed, the new tax measures could be implemented as early as next fiscal year. The coming weeks will see intense discussions as both supporters and opponents rally to shape the final version of the tax reform.